Interviewer: Christopher McNaughton

Guest: Nicholas Gontscharow, Data Governance Expert

Summary of Interview

In the interview with data governance expert Nicholas Gontscharow, conducted by Christopher McNaughton, the focus was on innovative data protection strategies in the context of Australian privacy regulations, especially in healthcare and finance sectors. Gontscharow emphasized the importance of integrating advanced technologies like AI and machine learning for proactive data discovery and classification, crucial for identifying and categorizing sensitive information. He highlighted the necessity of aligning with Australian Privacy Principles for secure management of personal information and discussed the evolution of data protection and lineage, including real-time monitoring and visualization tools for data flow. The primary business risks identified were data breaches, non-compliance penalties, and the loss of customer trust. Gontscharow foresees a future where data protection is an integral part of business operations, with an increased focus on data ethics and potentially tighter regulations.

Interview

Christopher McNaughton (CM): Welcome, Nick. It’s great to have you here to discuss the vital topic of data protection, especially in the context of current Australian privacy regulations.

Nicholas Gontscharow (NG): Thank you, Chris. It’s a crucial area, particularly in sectors like healthcare and finance, where data sensitivity is at its peak.

CM: Let’s dive right in. With the sheer volume and complexity of data increasing, how are organizations adapting their data protection strategies?

NG: The key is integration of advanced technologies with robust governance policies. We’re seeing a shift towards proactive data discovery and classification, which is foundational in understanding what data you have and how it needs to be protected.

CM: How does data discovery work in practice, especially in complex environments?

NG: Data discovery involves scanning systems to identify and categorize data. In healthcare, for instance, this might mean locating all instances of patient health information. The challenge is the multitude of systems where this data resides. The evolution of AI and machine learning is aiding significantly in automating and refining these processes.

CM: And once data is discovered, classification must follow I assume? How does that operate within these sectors?

NG: Absolutely. Classification is about labelling data based on sensitivity and regulatory requirements. For example, financial records and health information are classified at the highest sensitivity due to the Australian Privacy Principles (APPs) under the Privacy Act 1988.

CM: Speaking of the APPs, how are organizations aligning with these regulations?

NG: Compliance with APPs is non-negotiable. Organizations must ensure they manage personal information securely and restrict access. In healthcare, this includes complying with the My Health Records Act 2012, which sets out strict rules about handling health information.

CM: What about data protection and data lineage? How are these evolving?

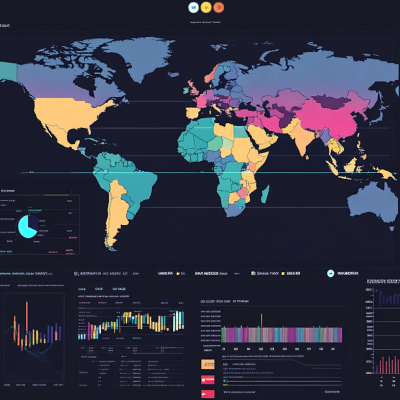

NG: Data protection now extends beyond traditional encryption and access controls. There’s an increasing use of real-time monitoring and anomaly detection to prevent breaches. Data lineage, the tracking of data from its origin through its lifecycle, is crucial for transparency. Tools are being developed to visualize and audit data flow, which is especially important in financial services to trace transactions and ensure compliance.

CM: With these strategies, what are the primary business risks organizations face?

NG: The biggest risks are data breaches and non-compliance. Breaches can lead to significant financial penalties, not to mention reputational damage. Non-compliance with regulations like the APPs can result in sanctions and loss of customer trust, which is particularly detrimental in finance and healthcare.

CM: In closing, Nick, how do you see these strategies evolving in the near future?

NG: We’re moving towards an era where data protection is integrated into every aspect of business operation. Expect to see more advanced AI-driven security measures, increased emphasis on data ethics, and possibly tighter regulations. The goal is to not just protect data, but also to use it responsibly and ethically, enhancing trust between organizations and their customers.CM: Nick, thank you for these insightful perspectives on protecting data in today’s complex and regulation-heavy environment.